Non-financial and sustainability reporting has become an integral part of business operations over the last number of years. However, understanding climate risk and opportunity continues to prove a significant challenge for investors and corporates alike. The EU Taxonomy is part of the broader EU Action Plan on Sustainable Finance which seeks to offer clarity to investors and large companies in relation to the sustainability of their business operations. In doing so, it is anticipated that the taxonomy will create security for investors, prevent greenwashing, help companies to become more climate-friendly and help shift investments to more sustainable initiatives.

Non-financial and sustainability reporting has become an integral part of business operations over the last number of years. However, understanding climate risk and opportunity continues to prove a significant challenge for investors and corporates alike. The EU Taxonomy is part of the broader EU Action Plan on Sustainable Finance which seeks to offer clarity to investors and large companies in relation to the sustainability of their business operations. In doing so, it is anticipated that the taxonomy will create security for investors, prevent greenwashing, help companies to become more climate-friendly and help shift investments to more sustainable initiatives.

What is the EU Taxonomy?

The EU Taxonomy is a list of economic activities with performance criteria for their contribution to six environmental objectives. It is part of a wider EU sustainable finance action plan to reorient capital flows towards a more sustainable economy. To begin with, large companies that fall under the scope of the Non-Financial Reporting Directive (NFRD) i.e. with greater than 500 employees, are obligated to comply with the EU Taxonomy. Those that fall under the incoming Corporate Sustainability Reporting Directive (CSRD) i.e. greater than 250 employees, will also be required to disclose their alignment to the Taxonomy.

What areas of sustainable development does the EU Taxonomy address?

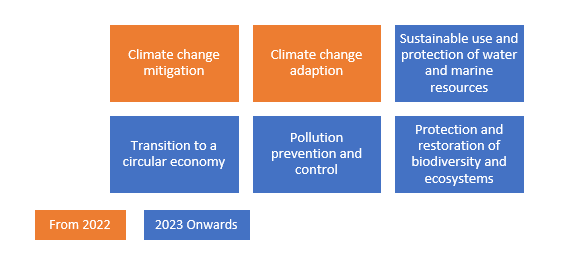

The EU Taxonomy targets six key environmental objectives:

Each of the above objectives contains a list of business activities with screening criteria, to identify whether the activity makes a substantial contribution to the objective. So far screening criteria has been issued for the first two climate change objectives of mitigation and adaptation, resulting in the identification of nearly 70 activities for each. It is anticipated that further criteria will be released for the remaining objectives, ahead of full compliance requirements in 2023.

Assessing the organisations economic activities.

As part of the initial process the company will undertake an evaluation process to identify if any of their current business activities makes a substantial contribution to one of the six environmental objectives as set forth under the remit of the Taxonomy. Once the company is satisfied that one or more of their current trading activities make a substantial contribution to one of the objectives, they must ensure, that the activity Does No Significant Harm (DNSH) to the remaining objectives.

Considering the environmental impact of a business activity is the main priority of the Taxonomy, however, companies must also consider the social impact by meeting the minimum social safeguards. Once an activity has met the above criteria, it can be considered Taxonomy-aligned and included as part of a disclosure. The Taxonomy seeks to address high emitting areas so in practice may have multiple Taxonomy-aligned economic activities or alternatively have very few. It will eventually expand to include a broader range of economic activities, which in turn may increase an entities level of alignment.

How does a company disclose its Taxonomy-alignment?

The Technical Expert Group (TEG) established by the European Commission have identified three Key Performance Indicators (KPIs) that companies must disclose in order to quantify their Taxonomy-alignment [1] the percentage of Turnover deriving from Taxonomy-aligned activities [2] the percentage of Capital Expenditure (CapEx) spent on Taxonomy-aligned activities and [3] the percentage of Operating Expenditure (OpEx) deriving from Taxonomy-aligned economic activities. Alongside these numeric KPIs, companies must disclose qualitative information including the companies accounting policy and any assumptions made during the calculation of each KPI.

When does the Taxonomy apply to Public Interest Entities (PIEs)?

The EU Taxonomy has adopted a phased approach to its introduction. Initially, companies will be required to report the percentage of their Turnover, CapEx and OpEx that is considered Taxonomy-eligible. In future years companies will be required to use the Technical Screening Criteria to assess if their activities are Taxonomy-aligned.

How can Clearstream Solutions help?

As a leading ESG corporate reporting advisory firm, Clearstream Solutions is well positioned to help companies seeking assistance with the EU Taxonomy and non-financial reporting related requirements. We can help you to identify how and to what extent the EU Taxonomy effects your business by performing a full analysis of your companies activities, assisting you in drafting the required disclosures, and by developing a reporting roadmap for future alignment. Please feel free to contact our ESG reporting team to discuss your needs.