What is the Gender Pay Gap?

The Gender Pay Gap is a measure of the difference in hourly remuneration of men and women across a workforce. In Ireland the Gender Pay Gap Information Act was introduced in 2021 requiring organisations with 250 employees or more to report their Gender Pay Gap in 2022.

It is important to note that the Gender Pay Gap is not a measure of discrimination or absence of equal pay for work of equal value. Equal pay for “like work” is a requirement under Irish law, whereas the Gender Pay Gap is a measure of gender representation across an organisation.

The most common driver behind the Gender Pay Gap is that females tend to be disproportionately represented in lower paid positions (lower pay quartiles), while more males occupy the higher paid positions (upper pay quartiles). The Gender Pay Gap can be significantly reduced or even eradicated when the ratio of males and females in each pay quartile matches the ratio within the organisation overall.

As well as it now being a legal requirement, studies consistently show that for companies that actively engage to eliminate any Gender Pay Gap, it improves productivity, drives innovation, aids attraction and retention of talent, and has a positive effect on bottom line.

Who does it apply to?

In 2024, organisations with 150 employees or more are being asked to report and will extend to those with 50 employees or more in 2025. The regulations are currently being revised to reflect the reporting obligations for organisations of this size.

What are the reporting requirements?

Currently, organisations are required to report on full-time, part-time, and fixed-term employees across:

- The Mean and Median gap in hourly remuneration.

- The Mean and Median gap in bonus remuneration.

- The % of men and women receiving bonus remuneration.

- The % of men and women receiving Benefit in Kind.

The regulation also requires the reporting of the respective percentage of employees who fall within 4 pay quartile bands across the organisation – low, lower middle, upper middle, and upper.

Organisations are asked to choose a snapshot date in June and calculations are to be completed based on remuneration data from the 12-months preceding this date. An organisation must report their Gender Pay Gap publicly on their website within 6 months of their snapshot date. For example, an employer who chooses a snapshot date of June 8th has a reporting deadline of December 8th.

An online Gender Pay Gap reporting system is currently being developed where companies will submit their Gender Pay Gap in future.

It is also a requirement for organisations to outline the steps they will take to reduce their Gender Pay Gap. To develop an effective action plan, further analysis on employee data can be completed to identify factors contributing to the pay gap and ensure problem areas are being tackled.

Some Helpful Tips to manage your Gender Pay Gap

The measurement and reporting of the Gender Pay Gap won’t solve the issue of gender balance alone, but it will enable your organisation to gain further insight into what is contributing to the pay gap and identify areas of opportunity for pay gap reduction.

Below are some helpful tips for your organisation relating to Gender Pay Gap measurement and management.

- Data management system

Calculating your Gender Pay Gap requires the collection and collation of many types of employee’s pay data. Having a robust data management system in place that will collect the required data in a suitable format is fundamental for Gender Pay Gap calculation. When collecting remuneration data, it is important to also collect other measures apart from gender for each employee, such as job title, division or department, and seniority level. These other measures can be used to extract further insight into your organisational Gender Pay Gap later.

- KPI Measurement

Aside from remuneration data we recommend tracking several KPI’s associated with the movement of people throughout the company. Completing analysis across these measures can give further insight into trends in recruitment, promotion, and employee retention to further support organisational decision making.

Examples of additional data you might measure are details of new joiners, leavers (including reason for leaving), hiring process information including the gender of those shortlisted and longlisted, details of those promoted during each year (including salary raises due to promotion), general salary raises, and % of those eligible taking maternity/paternity leave.

- Trend analysis

Once your Gender Pay Gap calculations are complete, we recommend taking a deeper dive into the data to identify Gender Pay Gap contributing factors. Identifying these contributing factors can support decision making and a strategy in lowering your pay gap. It can be helpful to compare employee remuneration between males and females across several categories such as seniority level, age, department, and number of years employed at your organisation.

For example, you may find the % of males being promoted is higher than the % of females being promoted. Identifying the cause of this difference can support your action plan towards lowering your Gender Pay Gap.

- Research & Awareness

Completing research on the causes of the Gender Pay Gap and solutions to reducing it, especially within your industry, can be a good starting point to understand the Gender Pay Gap context for your organisation. Benchmarking against peers can also indicate how you are performing on Gender Pay Gap within your industry. Communicating this information across your organisation from Board level to employees is important in driving your Gender Pay Gap reduction strategy forward.

- Strategy

Once you have completed appropriate analysis on your Gender Pay Gap data and identified problem areas, it is important to select initiatives and targets that relate to your identified problem areas. Examples of focal areas may include:

- Promoting pay transparency during the hiring process and ensuring employees understand how their pay is determined.

- Developing transparent, structured pay tiers with clear criteria for progression and pay increases.

- Investing in Education and Training to support progression of females through seniority levels.

- Addressing unconscious bias that may arise during hiring, promotion, and evaluation processes.

- Engaging with school and university students to educate females on their career opportunities, helping increase female representation in your organisation. This point is especially important if your industry is known to be male dominated.

How Can Clearstream Help?

Clearstream are currently working with several companies to help them calculate their Gender Pay Gap and prepare the supporting action plan. We also offer insight services to inform the development of the action plan.

If you would like more information on these services, please contact info@clearstreamsolutions.ie

Other Information Sources

The Irish government provide clear guidance on reporting requirements and calculation methodologies at gov.ie.

Goodbody Clearstream are delighted to share that Fran McNulty, Director Responsible Business is now a trained B Leader on the Irish B Leaders Database and can guide companies who are interested in B Corp certification.

Goodbody Clearstream are delighted to share that Fran McNulty, Director Responsible Business is now a trained B Leader on the Irish B Leaders Database and can guide companies who are interested in B Corp certification. What is EcoVadis?

What is EcoVadis?

Coca Cola

Coca Cola

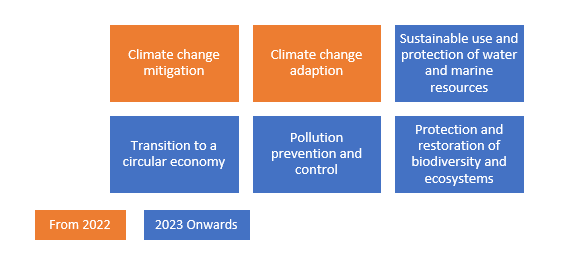

Non-financial and sustainability reporting has become an integral part of business operations over the last number of years. However, understanding climate risk and opportunity continues to prove a significant challenge for investors and corporates alike. The EU Taxonomy is part of the broader EU Action Plan on Sustainable Finance which seeks to offer clarity to investors and large companies in relation to the sustainability of their business operations. In doing so, it is anticipated that the taxonomy will create security for investors, prevent greenwashing, help companies to become more climate-friendly and help shift investments to more sustainable initiatives.

Non-financial and sustainability reporting has become an integral part of business operations over the last number of years. However, understanding climate risk and opportunity continues to prove a significant challenge for investors and corporates alike. The EU Taxonomy is part of the broader EU Action Plan on Sustainable Finance which seeks to offer clarity to investors and large companies in relation to the sustainability of their business operations. In doing so, it is anticipated that the taxonomy will create security for investors, prevent greenwashing, help companies to become more climate-friendly and help shift investments to more sustainable initiatives.